Health Insurance costs in Nigeria are on the rise. People are spending so much more on healthcare that paying out of pocket is becoming increasingly unaffordable for many. It is getting more common to receive appeals for donations for healthcare costs which could have been covered by a health insurance plan.

It’s no wonder that many individuals and employers are seeking out ways to secure affordable healthcare coverage. Getting full health cover in Nigeria may not be cheap, but it’s worth it!

Whether you are a young adult with no dependents and think that you don’t need to get health care cover, a parent with young children or elderly parents, or somewhere in between, this article is for you. If your employer doesn’t automatically give you insurance, or perhaps you are self-employed, should you bear the extra expense of paying for health insurance?

Keep reading as we discuss whether or not buying health insurance is worth it in Nigeria today.

What is health insurance in Nigeria ?

Insurance is a well-known tool for financial risk management. While money is not so easy to make, it is very easy to lose. People choose insurance to reduce the risk of them losing money, whether that is as the result of a medical emergency or other unexpected incident. In Nigeria, you can insure a number of things including a car, property, business, life and health.

Health insurance is simply protecting yourself from paying huge sums of money when you fall sick or have a serious health challenge, by paying a regular fee, known as a premium.

Depending on the plan you subscribe to, it can either cover all your medical bills or most of it and when it comes to choosing the right health plan, there are important factors you should consider.

How much does a health insurance plan cost in Nigeria?

The cost of a health insurance plan depends on two factors – the company and the type of plan you’re getting. In Nigeria, it is possible to get a health care plan for as low as N500 monthly. Presently, we offer free consultations to help you choose the best plan for you. Speak to our rep to get started now.

When is health insurance financially beneficial?

Health insurance is financially beneficial no matter what your life circumstances are. If you are young, strong, and healthy, a health plan is great for helping you manage the unexpected – that is, medical emergencies and accidents, as well as routine health check ups.

If you are managing a chronic condition such as asthma, diabetes, or high blood pressure, a health plan can be critical for helping you manage the cost of medications, tests, and hospitalizations.

When is health insurance NOT worth it?

There’s only one time when health insurance is not worth it – when one is dead.

If you are already subscribed to a plan, make sure you use it from time to time, go for checkups even when you are not ill. If you’re not yet subscribed to a plan, you should not waste any more second.

These days, we see people soliciting help to take care of their family member who just got seriously ill, whereas, the cost of treatment could have been completely absorbed or reduced by more than half if they had a health plan. Speak to our rep now to get free consultation for the best health care plan for you.

Read Also: Emergency Management in Nigeria: A guide

So, is health insurance worth it in Nigeria?

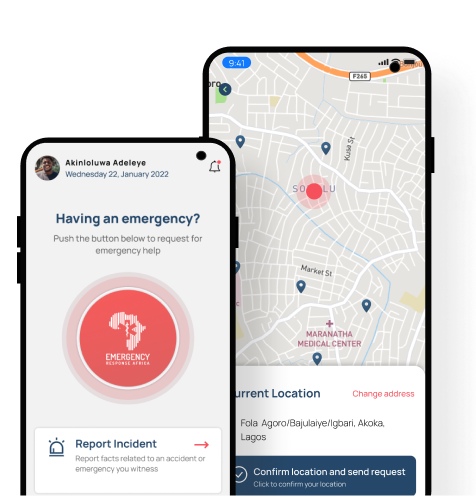

To live a long healthy life as a Nigerian, you don’t need just any kind of health insurance, you need a plan with an emergency cover. Emergency Management is not often talked about in Nigeria as it should, hence, we don’t plan adequately for it. Getting insurance is worth it in Nigeria but much more worth if it also covers emergencies and with the ERA TravelSafe Plan, you’ll get 24/7 health and security emergency cover this December and beyond.

Whether you are a Nigerian based in Nigeria or a Nigerian in the diaspora planning to spend their Christmas in Nigeria, the ERA TravelSafe Plan is created for your all-round enjoyment.