Atinuke woke up for the third time that night – 2:47 a.m. the alarm clock showed. She had had an uncomfortable tightness in her chest for most of the previous day, but she tried to push it aside. How long had it been since her last asthma attack? She couldn’t remember. But lying awake, breathing fast, she knew exactly what was happening. She tapped her husband who lay snoring beside her and once he came to, he began to panic. They had only been married a few months and he had never witnessed her asthma attacks. While he frantically tried to figure out what to do, Atinuke felt herself slipping. When she woke up next, she was in the hospital.

Days later, Atinuke’s husband narrated what happened after she fainted. He called their insurance customer care line for direction, but impatient with waiting, he put her in their family car and ended up driving to three different healthcare facilities before one accepted to treat her. He hit another vehicle in his haste and barely got to the third hospital because he had promised the vehicle owner payment and given him his second phone as collateral. The doctors peppered him with questions – why hadn’t they come sooner? Why didn’t she receive oxygen on the way? How could he let it get this bad? They rescued her and left him with a word of warning – they needed to be able to spot early warning signals and have an emergency action plan. “She shouldn’t have showed up here in such bad shape – there was almost nothing we could do. Just thank God she made it.”

Many Nigerians, much like Atinuke’s husband, find themselves compelled to navigate a complex and often inefficient healthcare system in times of crisis. This challenge is further compounded by the widespread lack of comprehensive health insurance coverage, as recent statistics clearly demonstrate.

In 2022 Leadway Assurance published an article showing that just 0.5% of Nigerians have insurance. While 28% of all cars on Nigerian roads are insured, just 3% of the population has health insurance, almost entirely employer driven. Despite being the largest economy in Africa, Nigeria’s insurance penetration is the lowest compared to South Africa (12.2%), Kenya (2.9%) and Ghana (1.2%).

Why is penetration so low?

There are many reasons but lack of trust, lack of awareness, and poor service delivery in terms of provider services and claims payment are some of the main reasons. Insurance companies of all types also struggle with appropriately profiling and pricing risks and distribution.

With such a challenging environment, insurance companies must find strategies to deliver quality services and build trust to attract more customers, while increasing profits for long-term viability.

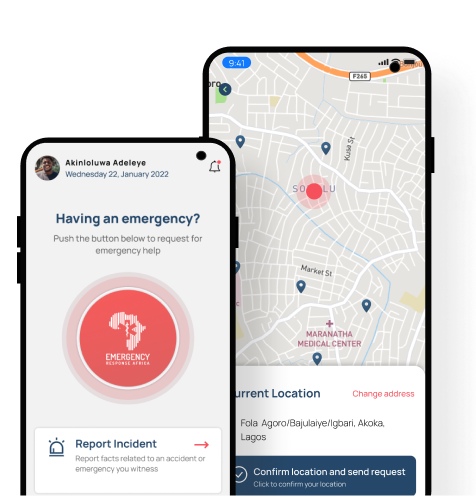

Emergency response plays a crucial role in helping your insurance company achieve all these goals. Whether your policyholders experience a vehicle accident, physical assault, or medical emergency, they want to know that their policy will deliver when the time comes.

Here are several ways in which emergency response efforts can benefit insurance companies:

- Mitigation of Losses:

Timely and effective emergency response can help mitigate losses by addressing and containing incidents before they escalate. Insurance companies can also collaborate with emergency services and first responders to develop joint strategies for risk reduction and management.

This encourages proactive risk management, reducing the frequency and severity of claims.

- Improved Risk Assessment and Enhanced Underwriting Practices:

Emergency response data and analysis provide valuable insights into the nature and severity of different risks. Insurance companies can use this information to enhance their risk assessment models, leading to more accurate underwriting and pricing. Sharing data and insights can also create a more resilient and interconnected system for preventing and handling emergencies.

- Claims Management and Processing:

Efficient emergency response can speed up the claims process by providing relevant data to enable the insurer to provide the appropriate coverage, reducing the financial impact on both insurers and policyholders.

A quick and accurate assessment of damages helps insurers process claims more rapidly and allocate resources effectively.

- Compliance and Regulation:

Collaboration with emergency response agencies helps insurers stay ahead of evolving regulations related to risk management and disaster response. Compliance with regulatory requirements can contribute to a positive reputation and trust among policyholders.

- Customer Loyalty and Trust:

Finally, prompt and effective emergency response can enhance customer satisfaction and trust in insurance providers. Satisfied customers are more likely to stay with their insurers, reducing the risk of churn and potentially leading to positive word-of-mouth referrals.

Effective emergency response not only reduces the impact of emergencies and disasters but also provides valuable data and insights that insurance companies can leverage to enhance their risk management strategies, underwriting practices, and overall business operations. Will you partner with an emergency response provider?

Emergency Response Africa is here to help you serve your policyholders better. Get in touch.