A health insurance is a protective plan used to cover the cost of medical bills when they arise. In Nigeria, health insurance schemes have existed since 2004 yet only 4 percent of Nigerians have health covers and the majority lack awareness of its importance.If you are reading this, it is likely you plan to have a health insurance cover for yourself or improve your current plan.

To help, we’ve put together some necessary factors to consider to enable you purchase the best insurance plan in Nigeria, including one that covers emergency services like what we offer at ERA. Enjoy!

Using a health insurance plan in Nigeria is not praying for an illness to happen

People who use health insurance in Nigeria, seem to be praying for the worst.In reality purchasing a health insurance plan in Nigeria is the smartest thing to do as paying for medical bills out of pocket can be expensive and sometimes break the bank!

To get health insurance in Nigeria, there are two broad routes you can consider. you have to go through these routes

1. The Public Route: The National health insurance scheme established in 2004 is the government body for health insurance in Nigeria. It’s cheaper than the private option and a great choice if you work in the civil service or in formal employment.

Using the NHIS is cheaper but expect to have less medical features covered which is why most Nigerians go private.

2.Private: More accessible than the national health insurance scheme are private insurance companies in Nigeria.

There are several types of private insurance companies in Nigeria, each offering specialized plans e.g POS insurance companies cover costs to hospitals of your choice while some like HMOs cover your bills only when you obtain treatment from selected hospital networks.

What are HMO’s and why are they the most used in Nigeria

Health maintenance organizations (HMOs) negotiate lower fees with selected hospitals for their services which makes them the more affordable plans in Nigeria or across the world worldwide.You however pay from your pocket if you choose to take treatment outside these selected hospitals.

There are several HMO companies in Nigeria but regardless of their variety each offers money saving features like:

- Individual.Medical cover for a single individual

- Family.A plan that lets you add multiple members under one cover

- Senior citizens. A plan for the gramps who require frequent medical visits.

- Maternity. Covers medical costs associated with child delivery.

Now when picking a health insurance plan in Nigeria you should put into consideration these 5 factors. Without them you are likely to make a blind decision.

1.Consider the situation

HMO plans are picked based on the situation i.e your cadre in life and what it requires.

For instance, it’s a no -brainer that an individual plan that covers the medical bills of only one person is great for singles while family plans covering 2 or more people is the ideal choice for married couples.

2.Consider a plan based on coverage not pricing.

Hospital stay, cost of surgery, maternity, etc are medical events covered differently by various HMOs. What determines if you enjoy cover for all these events is your premium i.e the amount you pay for your insurance…The higher your premium the more coverage or services you enjoy.

Look out to make sure you don’t purchase a cheap plan that doesn’t cover all your basic needs.

3.Use Riders

Riders are add-ons to a health insurance cover. Several HMOs in Nigeria offer add ons to increase the amount of services your original plan offers. Common add ons include

- personal injuries

- Daily stipend for critical illness

- Maternity coverage and newborn babies

4. Compare your hospital network

To enjoy the benefits of a HMO you have to be treated at a hospital in agreement with your health insurance provider.

Examine the list of hospitals your HMO partners with, to see if your local hospital is a partner. This makes accessing health services faster.

5.Use an Insurance plan with emergency cover.

A good health insurance plan in Nigeria or anywhere else should include an emergency cover. This helps to offset bills arising from emergency transportation to hospitals via an ambulance company.

Check to see if emergency services are featured in your list of benefits. when signing up for a health insurance plan in Nigeria.

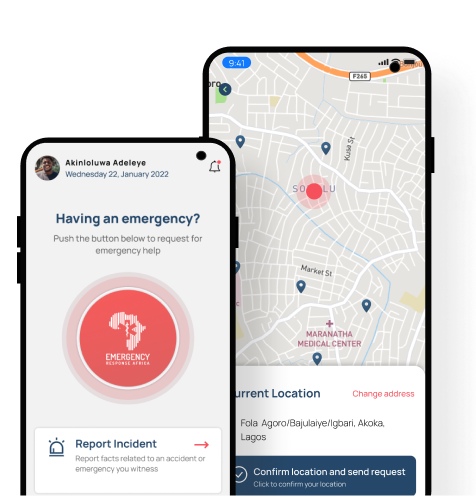

This enables you to receive speedy attention during an emergency which can make all the difference. If your plan doesn’t provide one, you can still enjoy emergency services by purchasing one directly from us.

Are you reading this from outside Nigeria and plan to visit soon? Then take advantage of our emergency plan for internationals in Nigeria. Its features promise you a worry-free stay in Nigeria.

Health is wealth, protect it.

As the saying goes, health is wealth. It’s a big plus if you can insure it against breakdowns like illnesses or injuries and with inflation shooting through the roof, health bills can be financially difficult if done out of pocket!

So make the smart choice today and work with an insurance plan to cover your associated medical bills like ambulance services without hurting your savings.